How Paul B Insurance Medicare Part D Huntington can Save You Time, Stress, and Money.

Wiki Article

Facts About Paul B Insurance Medicare Supplement Agent Huntington Uncovered

Table of ContentsWhat Does Paul B Insurance Medicare Health Advantage Huntington Mean?Paul B Insurance Medicare Insurance Program Huntington - An Overview

Health intends pay defines amounts for clinical costs or therapy and also they can use numerous choices and differ in their methods to protection. For assist with your certain worries, you may desire to chat with your companies benefits department, an independent professional expert, or contact MIDs Customer Services Department. Acquiring medical insurance is a really crucial decision (paul b insurance Medicare Supplement Agent huntington).

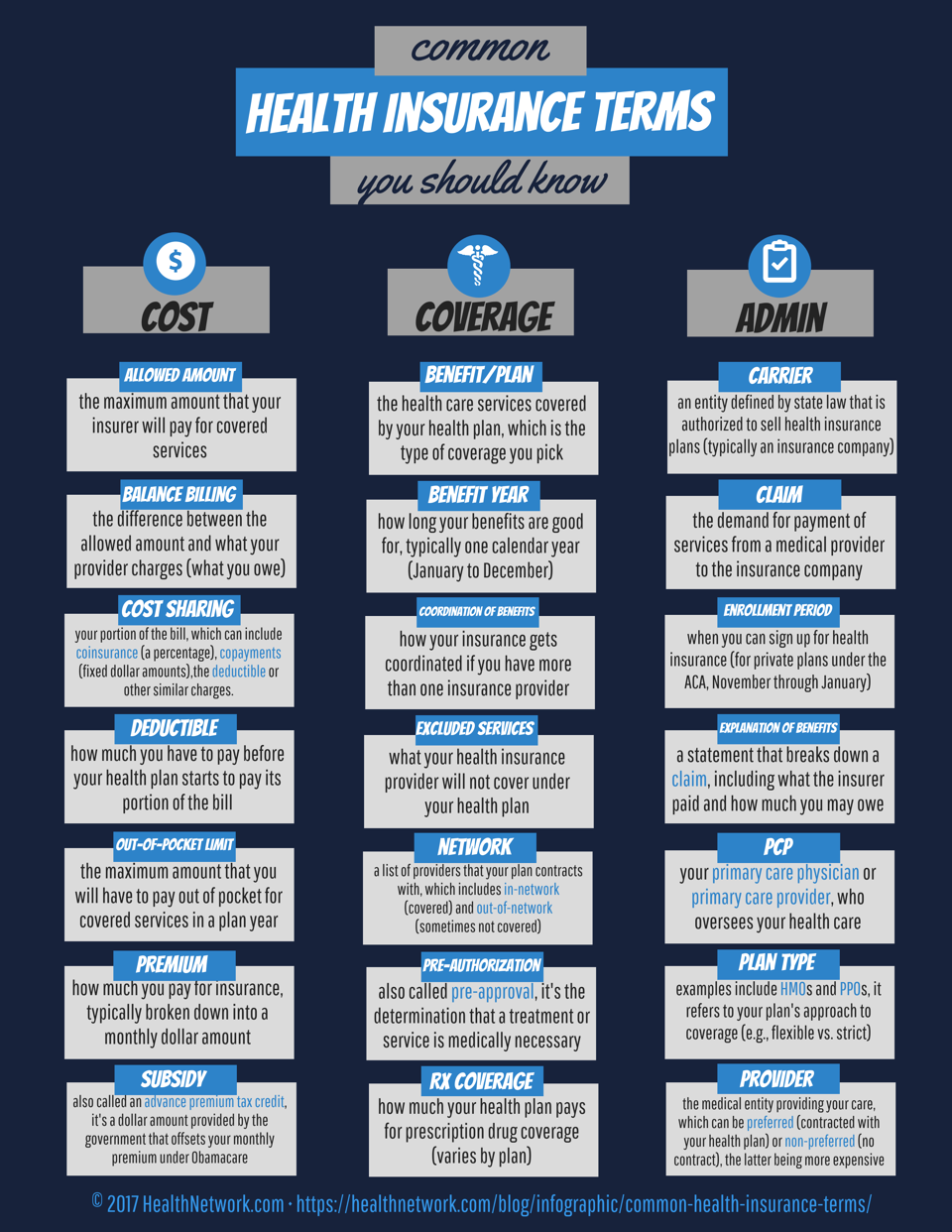

Numerous have a tendency to base their whole insurance policy buying decision on the premium amount. As obtaining a great value, it is additionally vitally crucial that you deal with a business that is financially secure. There are numerous different sort of wellness insurance coverage. Typical insurance typically is called a"fee for service "or"indemnity"strategy. If you have standard insurance coverage, the insurer pays the costs after you receive the solution. Managed care plans utilize your regular monthly payments to cover a lot of your clinical expenses (paul b insurance medicare agent huntington). Health And Wellness Upkeep Organizations(HMOs) as well as Preferred Carrier Organizations(PPOs )are the most common took care of treatment organizations. Handled care plans urge as well as sometimes require consumers to utilize physicians as well as health centers that become part of a network. In both conventional insurance as well as handled treatment plans, consumers might share the expense of a service. This price sharing is.

commonly called a co-payment, co-insurance or insurance deductible. Various terms are made use of in going over medical insurance. "Companies"are doctors, medical facilities, drug stores, labs, immediate care centers and other health and wellness care facilities as well as specialists. Whether you are considering signing up in a typical insurance policy plan or took care of treatment strategy, you need to know your lawful rights. Mississippi regulation needs all insurance providers to clearly as well as truthfully disclose the complying with details in their insurance policy policies: A total listing of items and services that the healthcare plan spends for. State laws limit for how long preexisting problem exemption durations can be for private as well as team health insurance plan. If you have a team health insurance, a pre-existing condition is a wellness problem for which medical suggestions, diagnosis, care or treatment was suggested or received within 6 months of joininga strategy. If you have a private strategy, a pre-existing problem is a health and wellness problem for which medical recommendations, medical diagnosis, care or therapy was recommended or obtained within 12 months of joining your plan. Your plan might reject to spend for services associated to your pre-existing problem for 12 months. You might not have to serve a pre-existing problem exclusion period if you have the ability to get credit rating for your wellness treatment coverage you had before you joined your new plan. Ask your prepare for more details. Your health and wellness insurance company need to renew your strategy if you wish to renew it. The insurer can not terminate your plan unless it draws out of the Mississippi market completely, or you commit scams or misuse or you do not pay your costs. All healthcare plans must have created treatments for receiving as well as settling problems. Grievance treatments have to be regular with state law needs. If your health insurance firm has refused to spend for health treatment services that you have received or wish to obtain, you can understand the exact legal, medical or other factor why. If you have a complaint regarding a health and wellness insurance firm or a representative, please refer to our File a Problem Web Page. Nevertheless, keep in mind that when you are comparing companies and also requesting the variety of problems that have actually been submitted against a firm, you must know that generally the firm with the most plans effective will have more problems than companies that just have a few policies in position. Every managed care plan have to file a summary of its network of suppliers and also just how it makes sure the network can supply wellness treatment services without unreasonable delay. Sometimes, a medical professional, medical facility, or other health and wellness treatment facility leaves a handled treatment strategies network. When this occurs, a taken care of treatment plan have to inform you if you saw that carrier regularly.

You have to obtain this checklist when you sign up, re-enroll, or upon demand. Every took care of care strategy need to hug track of the top quality of the health and wellness treatment services it supplies. Managed treatment strategies need to not utilize incentives or penalties that urge less care than is medically required. If you wish to know more about just how your strategy pays its suppliers, you must ask. The notice must consist of the major reasons for the denial and also directions on exactly how to appeal. Every handled treatment plan need to adhere to certain procedures if it establishes that a healthcare solution was not clinically needed, efficient, reliable or suitable. The procedures should be totally explained in the certification of protection or member manual. You must make a list of your requirements to compare to

The Single Strategy To Use For Paul B Insurance Medicare Supplement Agent Huntington

the benefits supplied by a plan you are taking into consideration. You need to contrast strategies to learn why one is cheaper than another. Provided below are some concerns you should ask when purchasing health and wellness insurance: What does the strategy spend for and not spend for? Will the strategy spend for preventative care, immunizations, well-baby treatment, chemical abuse, body organ transplants, vision care, dental care, the inability to conceive therapy, or long lasting clinical equipment? Will the plan spend for any kind of prescriptions? If it spends for some, will it pay for all prescriptions? Does the plan have psychological health advantages? Will the plan pay for long-term physical treatment? Not all strategies cover every one of ancillary health insurance the advantages noted above. Do rates enhance as you age? Just how usually can rates be changed? Just how much do you have to pay when you obtain health and wellness treatment solutions(co-payments and deductibles)? Exist any kind of limitations on how much you must spend for healthcare services you receive(out of pocket optimums)? Are there any type of limitations on the number of times you may obtain a solution(lifetime optimums or annual advantage caps)? What are the constraints on using providers or solutions under the plan? Does the health strategy need you to.see providers in their network? Does the health plan pay for you to see a medical professional or utilize a hospital outside the network? Are the network suppliers easily situated? Is the medical professional you wish to see in the network approving brand-new patients? What do you have to do to see a professional? Exactly how easy is it to obtain a consultation when you require one? Has the business had an abnormally high variety of customer issues? What occurs when you call the business consumer issue number? The length of time does it take to get to a genuine person? Wedded pairs in circumstances where both partners are provided health insurance with their jobs should contrast the insurance coverage and costs(premiums, co-pays and also deductibles)to figure out which policy is best for the family. Maintain all invoices for clinical services, whether in -or out-of-network (paul b insurance Medicare Advantage Agent huntington). In case you exceed your deductible, you may certify to take a tax reduction for out-of-pocket clinical bills. Consider opening up a Flexible Spending Account (FSA ), if your company offers one, which allows you to allot pre-tax bucks for out-of-pocket medical expenditures. : who may not yet have a full time job that uses health and wellness advantages must be conscious that in a growing number of states, single grown-up dependents might be able to continue to get wellness protection for an extensive period( ranging from 25 to 30 years old)under their parents 'wellness insurance plans even if they are no longer complete time pupils. with kids need to consider Flexible Spending Accounts if offered to aid my explanation pay for typical youth medical issues such as allergy examinations, braces as well as substitutes for shed spectacles, retainers and so forth, which are typically not covered by basic health insurance

All workers that shed or transform work must know their legal rights to continue their wellness insurance coverage under COBRA for approximately 18 months. At this life stage, consumers may wish to review whether they still need handicap insurance policy. Numerous will wish to choose whether long-term care insurance policy makes feeling for them(e. g., will certainly they be able to afford the premiumsright into seniority, when most need to utilize such coverage). If we can be useful, please see the Demand Aid Page for info on just how to call us. Medical insurance is necessary to have, yet it's not always understandable. You may need to take a couple of steps to make Visit Your URL certain your insurance policy will certainly pay for your healthcare costs. There are also a great deal of keywords as well as phrases to keep straight in your head. Right here's some basic details you require to know: Medical insurance aids spend for your healthcare. It likewise covers many preventive services to maintain you healthy and balanced. You pay a regular monthly expense called a costs to buy your medical insurance and also you may have to pay a part of the cost of your treatment each time you receive medical solutions. Each insurance policy firm has different policies for utilizing healthcare benefits. In basic, you will provide your insurance infoto your doctor or hospital when you go for care. The medical professional or health center will bill your insurance policy company for the solutions you obtain. Your insurance card proves that you have wellness insurance coverage. It consists of information that your physician or hospital will make use of to obtain paid by your insurance provider. Your card is additionally handy when you have questions concerning your health and wellness coverage. There's a phone number on it you can call for information. It may additionally provide essentials concerning your health insurance plan as well as your co-pay for workplace brows through. Physicians as well as hospitals often agreement with insurer to enter into the firm's"network."The contracts define what they will certainly be spent for the treatment they provide. Some insurance policy intends will certainly not pay anything if you do not utilize a network service provider (except in the instance of an emergency situation ). It is crucial to get in touch with the strategy's network prior to looking for treatment. You can call your insurance policy company making use of the number on your insurance card. The business will inform you the doctors as well as medical facilities in your location that belong to their network.

Report this wiki page